Private debt

Page views: -

What is private debt?

Private debt derives from a loan provided by a lender other than a bank. The terms and conditions of such a loan are set out in a contract and the debt so created may also be embodied in a security, such as a bond.

Negotiations on the provision of private lending and its exact terms and conditions take place directly between the prospective debtor and the prospective creditor (a non-banking institution). This makes private debt a highly flexible, speedy option suitable as a source of financing for a wide range of investment plans and business needs. Securing a private loan is usually associated with reduced administrative costs in comparison to the issuing of securities, with an impact on the total costs of financing.

When to use private debt?

Small and medium-sized businesses often use private debt as a source of financial resources to fund continued growth when they wish to avoid selling a shareholding while they face difficulties accessing a suitable bank loan.

Financial resources can be raised by means of private debt at any stage of a company’s development, while there is reasonable expectation of profit being generated to pay interest and repay the loan principal. It is essential to convince the prospective lender not only of the future success of the business plan to be financed with the loan, but also of sufficient managerial skill at the company’s disposal and of the business reliability of the company itself. Lenders generally request an assessment of the risks involved as well as of the ability to generate sufficient profit to repay the loan.

Lenders prepared to provide a private loan can provide the financial resources relatively quickly. They are also usually flexible in terms of the loan parameters. If a project to be funded involves an increased level of risk, the lender usually requests additional guarantees or a combination of the private loan with a shareholding in the company.

Typical situations in which companies look to secure a private loan:

- Major business expansion and/or investment in fixed assets

- Funding for an acquisition of another company

- Optimisation of sources of funding (adjustments to the debt-to-equity ratio)

- Desire to achieve medium-term financial stability

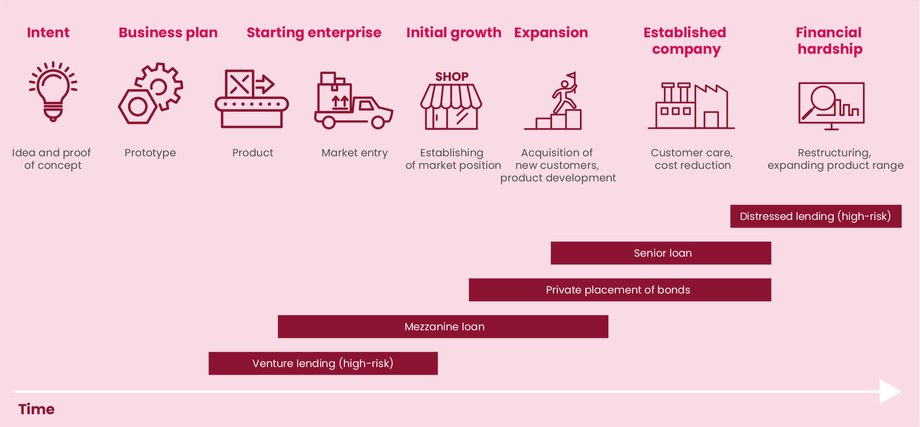

Private debt accessibility at various developmental stages of a company and its business operations

* in case of high-risk, a loan can be provided on its own or in combination with equity funding

Benefits of private debt

Compared to bank loans, private loans remain accessible as a source of funding even in situations that are too risky for banks to accept. As such, they offer a degree of flexibility in loan terms which allows the loan to be matched to the stage of development of the creditor and its business plan. Companies can therefore acquire bigger loans to finance more ambitious projects and faster growth.

Another significant quality of private loans is the reduced time required for provision of the financial resources. This enables companies to respond in a rapid and flexible manner to changing market conditions.

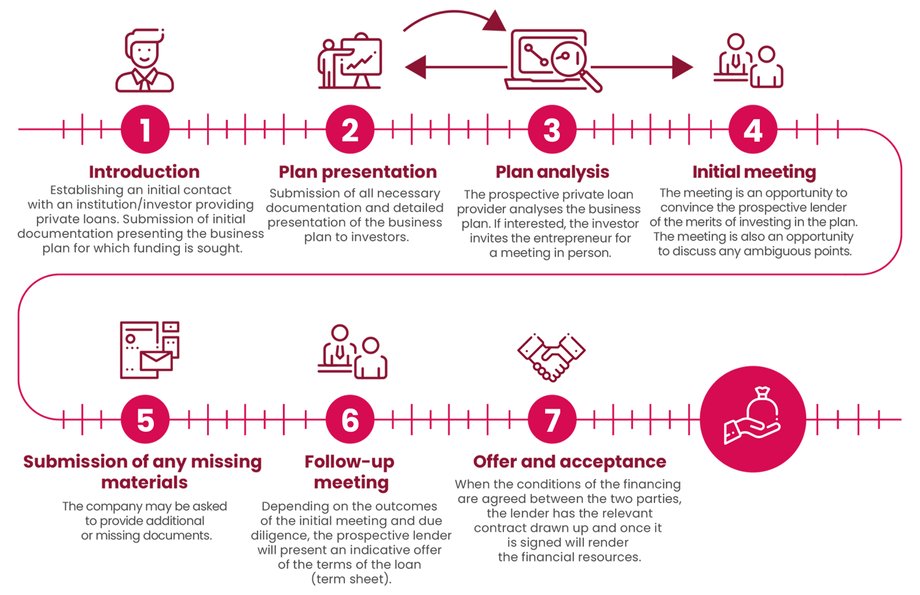

Securing a private loan

Private lenders will be primarily interested in the prospective creditor’s financial results and prospects. It is entirely up to the borrower to convince the lender of the merits of providing the loan. A well-designed business plan will go a long way in helping to achieve this.

The duration of the whole process varies and depends on the needs and readiness of the company seeking financing. It can be completed successfully in as little as three months, but usually takes between three and six months.

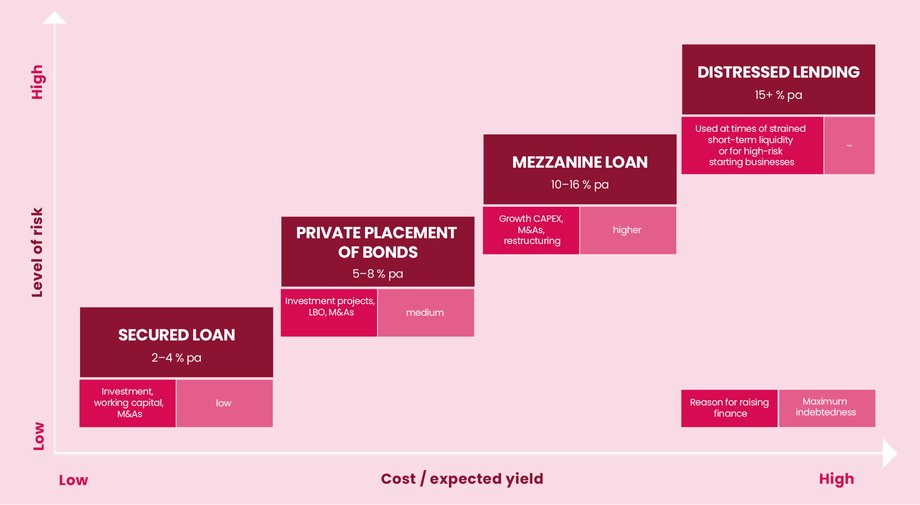

The cost of private debt

The cost of financing through private debt depends primarily on the degree of risk involved in the business plan or project to be funded. In addition to interest, lenders, such as funds, often also charge a fee to cover their initial costs associated with the transaction, usually in the range of 0.5% to 2.0% (depending on the complexity of the transaction and the amount of the loan).

* similar to a mezzanine loan, distressed lending can come through as a standalone loan or in combination with the sale of a shareholding in the company (equity).

Advantages and disadvantages of private debt

- Bridging of a financing gap caused by limited access to senior (typically bank) loans or equity funding

- Assessment of forward-looking creditworthiness

- Speed and flexibility of the process of raising financial resources

- Room for negotiation with the lender regarding the loan terms

- Accelerated growth thanks to flexibility of financing available at different stages of company development

- Potential for increased influence of creditors, especially if the debtor is in financial distress

- Higher interest rates compared to bank loans due to higher risks involved, reduced liquidity and reduced options for selling the debt on the market

Types of private debt

Lenders generally specialise in financing different types of businesses, mainly according to the risk levels associated and the stage of business development of the borrowers. For a borrower, it is therefore essential to identify the areas of focus of prospective lenders and the corresponding developmental stages in which different types of lenders may be beneficial to a company.

Basic types of private debt

Secured private debt

Private placement of bonds

Mezzanine

Venture debt

Distressed debt

Secured private debt

The term “secured private debt” describes loans provided by the lender directly to the borrower, without the involvement of an intermediary, while the loan is secured against default by assets of the borrower.

Compared to banks, private lenders are usually more flexible when it comes to their requirement for collateral and project profitability in the early stages. However, secured loans are still generally available only for projects with a high probability of success. The requirements for considerable guarantees and a low level of risk pose the main obstacles to the availability of secured (senior) loans as a source of financing for projects with a higher inherent risk, including those in early stages of business development.

What will convince a private lender of the merits of providing a loan?

- Prime debt guarantees

- Solid financial results, and positive cash flow in particular

Private placement of bonds

A private placement of bonds is a way to arrange a financial loan between a company and a private lender. In this case, a company issues bonds and sells them in a non-public, private offering. The sale is usually arranged beforehand between private lenders and the issuer.

Click here to read about bonds.

Compared to secured debt, financing through a bond issue can be more flexible. Despite slightly reduced guarantees, this method of raising capital can be available even for projects with mildly higher levels of risk. By issuing bonds, companies may be able to raise greater volumes of financial resources to accelerate their growth.

What will convince a private lender of the merits of subscribing to bonds in a private issue?

- Solid financial results

- Expected high returns of the funded project

Mezzanine

Mezzanine debt stems from a loan with a risk level that slots in between senior debt and equity. It is usually turned to when banks become reluctant to provide financing (most often due to their conservative strategies and/or requirements for considerable collateral) while equity is insufficient for satisfactory funding to achieve accelerated growth.

- Mezzanine debt is a form of a subordinate debt secured by the option to acquire a shareholding in the company, including influence over its management, in the event of default. As a subordinate debt, it is repaid only after secured/senior liabilities have been settled.

- Mezzanine loans often offer the payment of the interest only over the term of the loan, with the principal being repaid at project maturity when the funded project is expected to be generating profits.

- By definition, mezzanine loans carry a higher level of risk for the lender. This is reflected in the higher interest rate (cost to the borrower). However, mezzanine loans can provide access to greater volumes of financing to enable the realisation of more extensive projects and faster growth.

- The terms of a mezzanine loan may include a clause setting out the conditions under which debt can be redeemed by the transfer of a shareholding.

What will convince a private lender of the merits of a mezzanine loan?

- Expected high profits generated by the funded project

- Skilled team and organisational structure fit for purpose

Venture debt

Venture debt relates to loans provided to new businesses to tide them over in the early periods of their existence before they begin generating profits. Such companies can use the loan to supplement equity financing at advanced stages of product development or to fund initial growth while they develop in the right direction but are yet to generate profit. The loan also offers an alternative to companies reluctant to sell a shareholding and wishing to minimise exposure to third-party ownership.

- This type of loan often includes the option to pay only the interest over the term of the loan with the principal being repaid at project maturity when the funded project is expected to generate adequate profit. The loan can be secured by a capitalisation option (conversion to equity) or other guarantees (in accordance with loan terms agreed in advance).

- Interest can also be accumulated rather than paid (payment in kind adds owed interest to the principal), providing greater leeway in terms of cash flow.

What will convince a private investor of the merits of venture lending?

- Prospective borrower’s improving financial results

- Higher interest rate and the option to acquire a shareholding and/or other lender “bonuses”

- Fulfilment of intermediate steps in accordance with business plan

- Skilled team

Distressed debt

Distressed debt refers to lending intended to finance high-risk projects or businesses in financial distress where insufficient liquidity poses a serious threat of insolvency. Having enough ready money is also essential to tide a company over in a difficult period until revenue can be reliably generated again.

- This type of loan often includes the option to pay only the interest over the term of the loan with the principal being repaid at project maturity when the funded project is expected to generate adequate profit. As such, it provides some leeway to the overindebted company for restructuring and finding its feet again.

- Distressed lending is often available from venture funds that use it as a supplementary source of funding for businesses in financial trouble.

- Distressed debt can be secured by an option to convert debt into equity or other guarantees (covenants agreed in advance and setting out financial terms and conditions).

What will convince a private investor of the merits of distressed lending?

- Existence of a stable customer base

- Possibility of restructuring a potentially stable company in a short enough time frame

- Valuable product, intangible asset, brand or know-how

What next, where to turn?

When searching for the right provider of a private loan, it is essential to match the lender’s area of focus to the needs of the company. Different lenders specialise, for example, according to the size of the borrower, their sphere of business or the level of risk associated with the project to be funded.

Raising funds through a private loan is an important strategic step, not taken daily. However, it should still be executed in the right way at the first attempt. For most companies it would be uneconomical to employ experts specialising in capital markets and responsible in the company solely for this area. It is therefore advisable to hire outside advisers for the task.

Advantages of relying on a specialist adviser:

- They have the necessary skills and extensive experience with the processes involved in securing financial resources through private loans.

- They can assume control of the whole process and they are rewarded for its success.

- They can help to secure favourable transaction conditions.

Tips and contacts

How to use the website to obtain financingLegal advisersFinancial advisersLegislation and regulations relevant to private debt

- Private lending associated with business activities is governed primarily by private law legislation. The Civil Code generally governs agreements and contracts concluded under the Czech legal system. Agreements and contracts concluded with foreign lenders may be subject to foreign legislation.

- Certain private lenders, such as investment funds, may be subject to special public law rules governing their activities in terms of prudent conduct. However, these rules are usually concerned with safeguarding necessary processes as well as the stability of lenders, or with protecting the interests of investors who provide such lenders with funding for their activities.

- The rules for managers of investment funds providing private lending are defined primarily by the EU’s Alternative Investment Fund Managers Directive (AIFMD) transposed into the Czech legal system by Act No. 240/2013 of the Czech Legislative Code, on investment companies and investment funds, as amended.