Innovative shareholding platforms

Page views: -

What are innovative shareholding platforms?

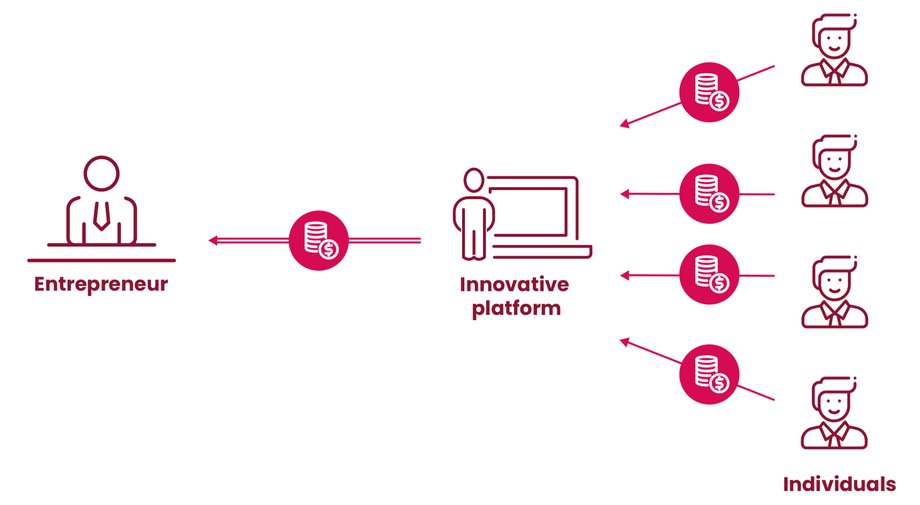

Innovative shareholding platforms offer businesses an opportunity to access what is known as crowdfunding. They let small and medium-sized enterprises address potential investors online and raise capital (extra sources of finance). Greater numbers of members of the general public can, serving in the investor role, each provide relatively small amounts that let companies raise capital, usually in the range of millions of koruna, to fund further business development.

For example, an amount of CZK 6m can be provided by 200 people, each contributing CZK 30,000 on average.

In return for the financial resources provided, the investing members of the public expect to receive a share in the profits and an increase in the value of their shareholding that can be sold on later, if they so wish. Innovative shareholding platforms are responsible for mediating the transactions in which investors obtain shareholdings in a company in return for the financial resources provided.

As the company rarely sells more than a minor stake, its existing owners generally retain control over both its strategic and day-to-day management. By selling a stake, existing owners primarily take on a duty to keep the new shareholders informed and organise regular general meetings.

How do innovative shareholding platforms work?

At first sight, an innovative shareholding platform looks like any other website. However, the purpose of an innovative shareholding platform is to facilitate contact between the public (investors) and businesses. Businesses present themselves to potential investors with their respective business stories, with the products and/or services they offer, and the team behind the business. Financial results may often be of secondary importance.

The cooperation between the two parties is mutually beneficial: businesses raise funds for their growth and development while their investors obtain an opportunity to collect a dividend and see their shareholding increase in value.

Online shareholding platforms connect a wide range of ordinary people acting as investors with business projects that have the potential for growth. Such platforms enable investors to support companies starting out and/or innovative projects. Companies thus have another financing option available even for their riskier projects. As the funds raised are obtained in return for a shareholding, there are no debts to be repaid to investors. This characteristic makes the option viable, even for projects that take time to begin generating a profit yet promise a significant increase in value over the longer term.

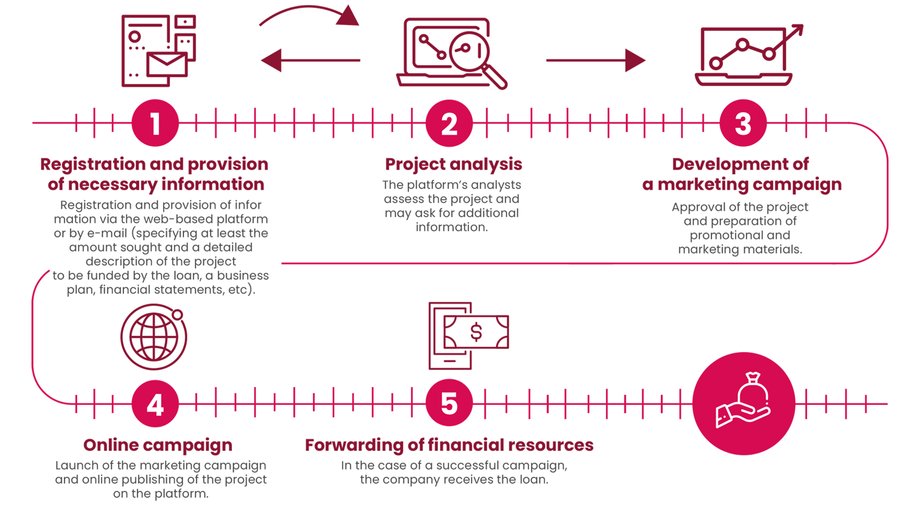

Innovative shareholding platforms act as mediators for businesses seeking to raise capital through the sale of equity online. The process usually consists of the following steps:

Securing funding through an innovative shareholding platform is a fairly straightforward and rapid process. The actual time required may vary depending on the type of platform used; however, it usually takes around three to five weeks to create the necessary documentation and online marketing campaign. The campaign itself then usually lasts between 30 and 60 days in order to allow enough time to raise the required amount from the platform’s users (general public).

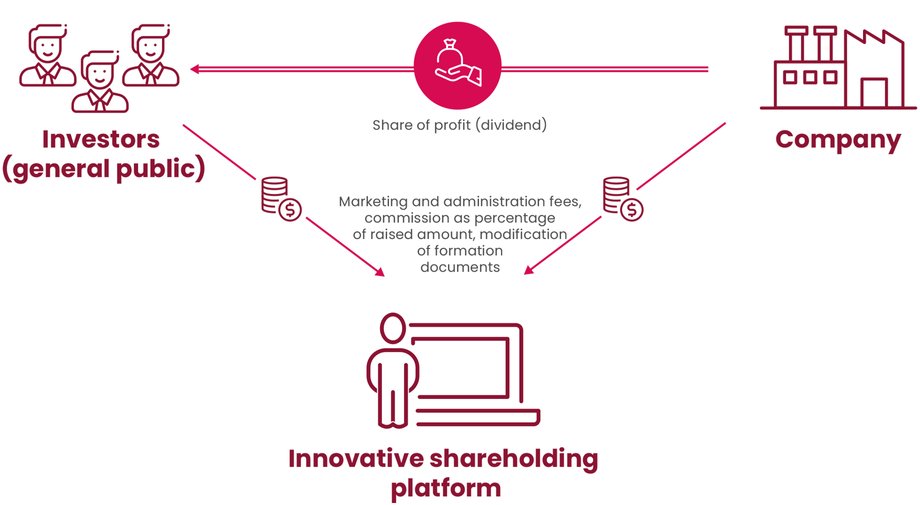

How much does it cost?

Raising funds on an innovative shareholding platform is normally associated with some internal costs for the company as it is necessary to prepare the required financial statements and information about the project to be funded. Depending on the type of platform, the company can also carry the costs of the marketing campaign to attract investors, administration fees and a commission for the platform, which varies according to the amount raised.

- The service fee usually ranges between 5% and 10% of the amount raised, depending on the platform used.

- Some platforms also bill a fixed amount in tens of thousands of koruna to cover the costs of the necessary legal documentation and marketing materials.

- It is also necessary to consider the costs, in tens of thousands of koruna, of modifying the company’s formation documents.

The company also may, or may not, share its profits with its shareholders. In return for their acceptance of the associated risks, investors at least expect adequate growth in the value of their investment.

When to use an innovative shareholding platform

Innovative platforms can serve as a source of funding if an amount in the millions of koruna is to be raised relatively quickly. There is no legal upper limit on the amount sought. However, the target figure does have an impact on the subsequent publication duties of the company. If the amount sought exceeds EUR 1m, the requirement for a prospectus will apply. Innovative shareholding platforms are suitable as an alternative source of investment in the development of a business starting out, moderate expansion of existing operations, marketing, working capital and entering new markets.

- As opposed to innovative lending platforms , innovative shareholding platforms can be a source of financial resources even for enterprises that are yet to turn a profit but promise significant growth potential.

- Innovative shareholding platforms are not best suited to raising capital for purchasing equipment or acquiring another business, as these needs are better served by cheaper financing through debt.

- Financing through innovative shareholding platforms is suitable for enterprises soon after they are founded, if they can provide financial statements and convince investors of the viability of their projects in a way that meets the platforms’ admission criteria.

What benefits does raising funds on an innovative shareholding platform bring to the business?

The main benefit of innovative shareholding platforms lies in their speed, coupled with the promotion of the business seeking finance and its establishment on the market. Raising funds in return for the sale of a minority stake on an innovative shareholding platform offers the benefit of flexible use of the funds raised. By selling a shareholding, the company also increases its capital and sees a positive impact on the accessibility of additional financing through debt.

Non-financial benefits

In addition to financial resources, the company also obtains feedback from investors and the market in general, in terms of ascertaining the demand for its project. The associated marketing campaign can also bring in new business partners and customers.

Advantages and disadvantages of innovative shareholding platforms

- Feedback on the attractiveness of the project to be funded, raising awareness of one’s business.

- Flexibility, speed, reduced bureaucracy.

- A successful campaign on an innovative platform reflects interest from investors and the market in general, which can make it easier to access other forms of financing in the future.

- Costs of campaign preparation, costs of promotion, higher transactional costs.

- Sale of a shareholding in the company.

- Risk of failure to attract investors, risk of raising less than expected.

Debt or share in ownership?

While taking on a debt requires the borrower to pay fixed interest regardless of profits or the existing situation in the market, the sale of a share in ownership (e.g., shares of stock) through an innovative platform brings in new investors and funding (capital) that need not be repaid. However, with the sale of shares, the company management also takes on responsibility for the new, usually anonymous, shareholders who are entitled to their share of equity and profits.

The main characteristic of the sale of a shareholding is the higher degree of risk for the investors, as opposed to the situation with simple debt, since in the event of the business getting into difficulties, the investors’ stakes are the last to be settled. That is why investors generally demand higher compensation in the form of growth in the value of their shareholdings. It makes this method of raising extra financial resources more expensive for the business.

Click here to read about innovative lending platforms

Selling a stake in the Czech Republic vs abroad

For companies aiming to operate and grow solely in the Czech or Slovak markets, it makes sense to choose from local innovative platforms and offer shareholdings to domestic investors. Where ambition exists to develop and attract the majority of customers abroad, it is advisable to consider opting for a platform operating in the target foreign market as the associated marketing campaign would be addressing not only potential investors but also potential customer and business partners in that market.

The European crowdfunding market is rather fragmented, mainly due to the different languages spoken and the different regulations applied in the various markets. Companies with ambitions to operate in multiple countries would do well to choose a platform available on the main foreign market or a platform operating in the language of the company’s target audience among investors and customers. It goes without saying that the company must be able to convince the target audience of the merits of its business plan.

Securing funding abroad is usually more expensive and riskier, not least because it requires the company seeking to raise capital to acquaint itself with the local regulatory environment. On the other hand, once a company decides to enter a foreign market, becoming acquainted with the local environment can only be beneficial to its efforts at establishing itself in the local market.

Practical example

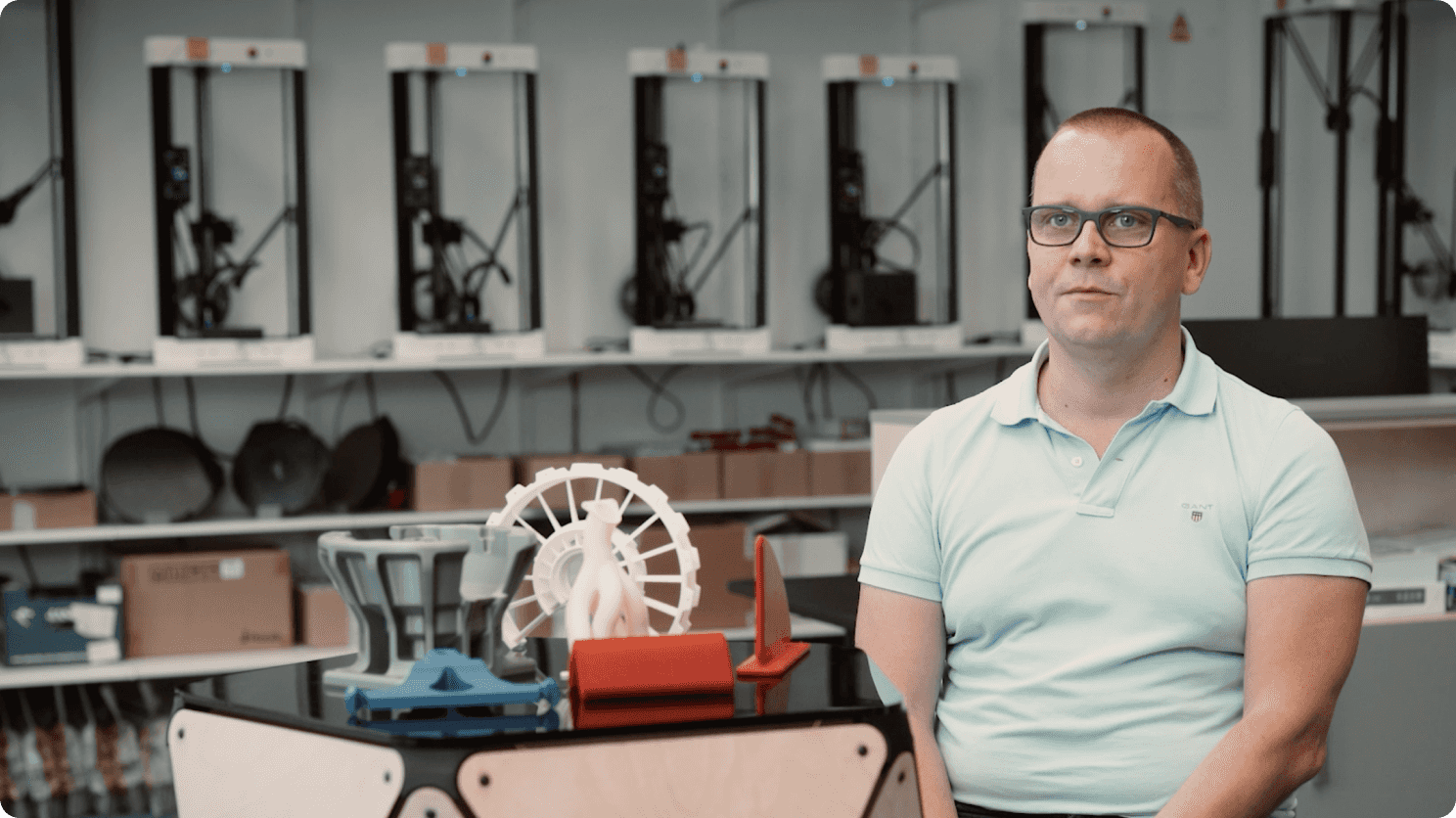

Trilab Group invited shareholders to the company

Trilab Group manufactures 3D printers. The company wanted to embark on organic growth based on product sales or otherwise accelerate expansion. Trilab decided to try the Fundlift online share platform to obtain external capital. The video shows how Trilab Group set the rules, how much of the company it eventually sold off and how long it took for the contract to be signed.

What next, where to turn?

Before embarking on the journey, it is advisable to become acquainted with the services and platforms available. It is also wise to contact several such platforms and compare their services and costs. Of course, it is possible to investigate a platform’s manner of operation directly, or to request its advice.

The next step is to commence negotiations on acceptance of the project to be funded via the chosen platform. This includes preparation of all necessary documentation such as financial statements, growth and development plans and the company’s marketing story.

Once the chosen platform has been contacted, its representatives guide the company through the whole process from the preparation of the necessary documentation and the promotional campaign to the publishing of the project online and securing of the funding.

Tips and contacts

How to use the website to obtain financingLegal advisersFinancial advisersLegislation and regulations relevant to innovative shareholding platforms platforms

- The core legislation governing company ownership and transfers of ownership to limited liability and joint-stock companies is Act No. 90/2012 of the Czech Legislative Code, on commercial companies and cooperatives, as amended.

- A fundamental legal regulation governing innovative shareholding platforms is Regulation (EU) 2020/1503 of the European Parliament and Council of 7 October 2020 on European crowdfunding service providers for business and amending Regulation (EU) 2017/1129 and Directive (EU) 2019/1937 (crowdfunding regulation), effective as of 10 November 2021.

- The core legislation governing the conduct of business on capital markets is Act No. 256/2004 of the Czech Legislative Code, on the conduct of business on capital markets, as amended.

- The relevant legislation and regulations are supplemented by those issued and applied by the Czech National Bank (ČNB).