Innovative lending platforms

Page views: -

What are innovative lending platforms?

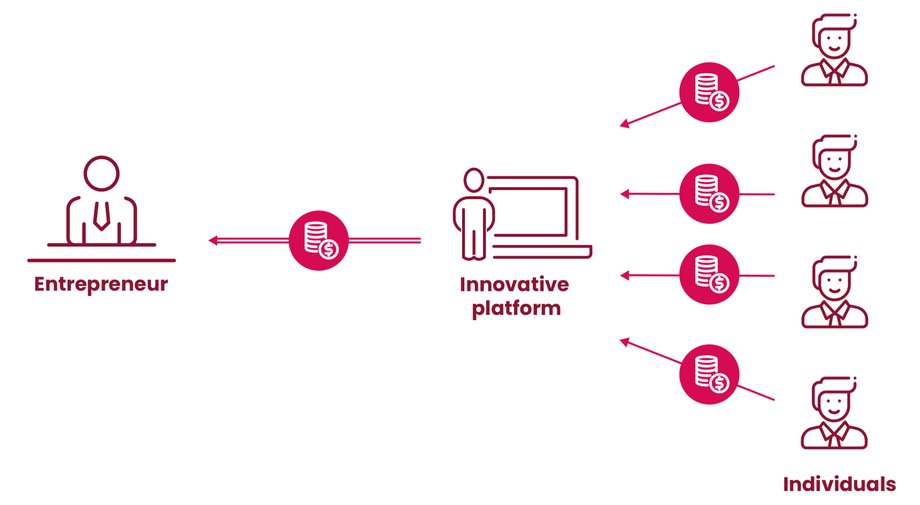

Innovative lending platforms rely on online solutions to provide access to crowdfunding. These platforms enable the acquisition of loans from the general public. Greater numbers of investors (lenders) can contribute comparatively small amounts to fund debts of usually not more than millions of koruna.

(For example, a loan of CZK 6m can be provided by 200 people, each contributing CZK 30,000 on average.)

The public lends financial resources to the debtor under the condition that they are repaid with interest.

Depending on the particular business model of the lending platform, the debt can be backed by a security or an agreement. The debtor-creditor relationship can be formed directly between the borrowing company and the individual investors or between the company and the platform that acts as a single creditor on behalf of the individual investors.

How do innovative lending platforms work?

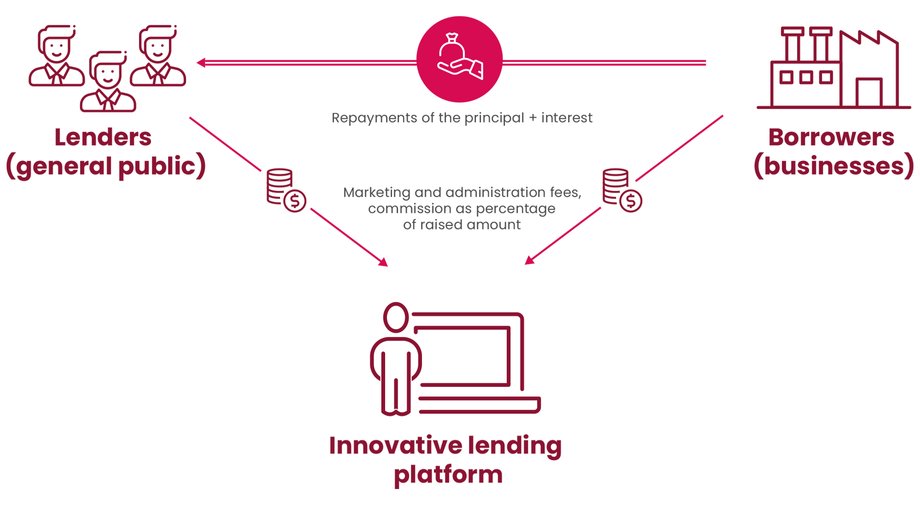

At first sight, an innovative lending platform looks like any other website. However, its purpose is to facilitate contact between the public (lenders) and businesses. The cooperation between the two parties is mutually beneficial: businesses raise funds for their growth and development while their lenders receive back the money loaned plus interest.

Funding through such platforms can be viewed as an alternative to bank loan financing. Compared to banks, lending platforms can be a source of funding for projects that may seem too risky for banks.

By going to an innovative lending platform, a company can obtain:

- Financial resources

- Feedback from lenders

- An idea about general interest in a project, product or service

- New customers acquired on the back of a marketing campaign

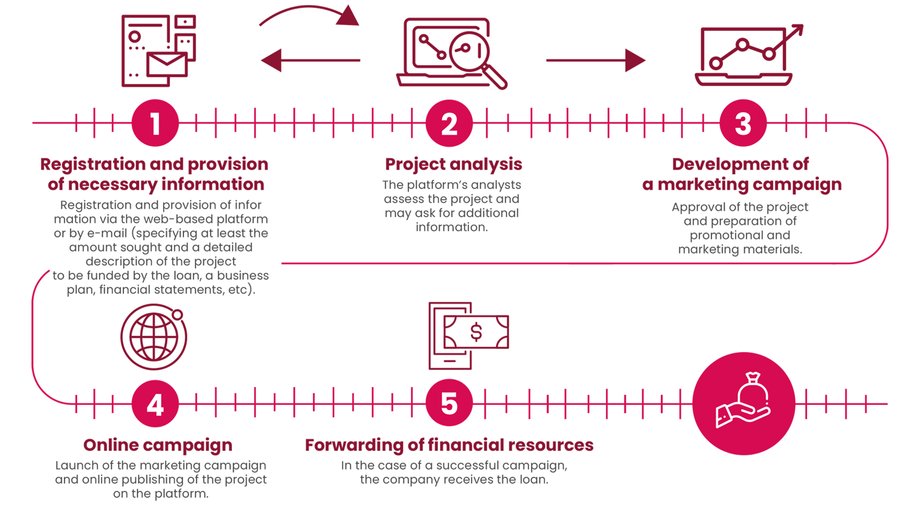

The process of raising funds through an innovative lending platform usually consists of the following steps:

Securing funding through an innovative lending platform is relatively simple and rapid. The actual time required may vary depending on the type of platform used, but if a company aims to issue bonds, it usually takes around three to five weeks to create the necessary documentation and online marketing campaign. The campaign to raise funds then usually lasts between 30 and 60 days to allow enough time to raise the required amount from the platform’s users (the general public).

How much does it cost?

Raising funds on an innovative lending platform is normally associated with some internal costs for the borrower as it is necessary to prepare the required financial statements and information about the project to be funded. Depending on the type of platform, the borrower can also bear the costs of the marketing campaign to attract lenders, administration fees and a commission for the platform, which varies according to the amount raised.

- The service fee ranges from 2% to 7% of the amount raised, depending on the platform and the actual amount raised.

- Some platforms also bill a fixed amount in the tens of thousands of koruna to cover the costs of the necessary legal documentation and marketing materials.

- Bond-based platforms also re-invoice the listing fee, usually in the lower tens of thousands of koruna.

The borrower also pays a sum of interest to its creditors as a reward for lending and taking on the associated risks.

When to use an innovative lending platform

Innovative lending platforms can serve as a source of funding if an amount ranging from millions to the lower tens of millions of koruna is to be raised relatively quickly to finance, for example, further development of an enterprise, its marketing or working capital.

Raising funds in this manner is suitable for businesses with an operating history of at least three years. They must also be able to provide financial statements for at least the two most recent years and meet the admission criteria of the lending platform concerned. The borrower’s financial statements should provide enough information to convince lenders that they are capable of repaying the debt and that there is an acceptable level of risk.

Comparing funding through peer-to-peer platforms and bonds

- Bonds defer the repayment of the principal, or the nominal value, unlike a bank loan, which requires gradual repayment of the principal.

- Debts from borrowing through an online platform (people-to-business loans) are usually repaid similarly to a regular bank loan, i.e., in instalments, repaying both the principal and interest. There are also platforms that offer deferred repayments of the principal and its repayment in full at a later date. In the latter case, agreements are usually concluded between the borrower and each of the lenders.

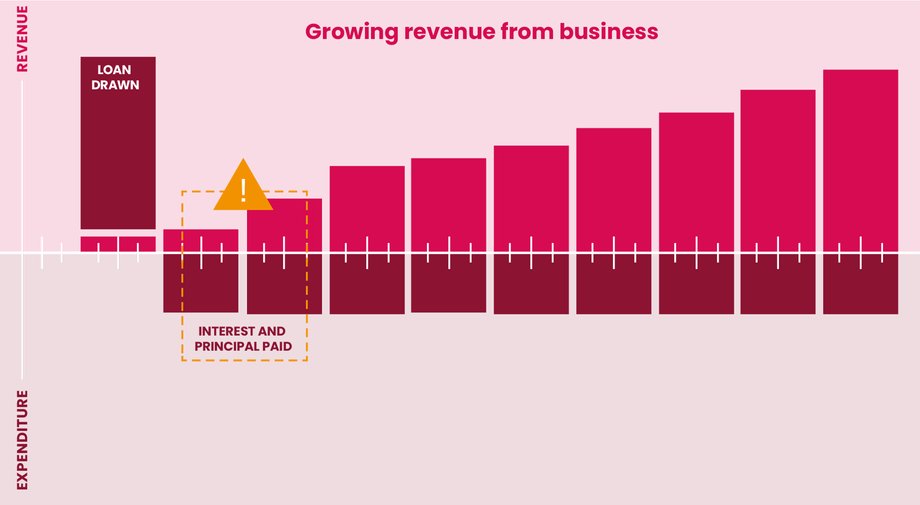

Advisable timing in terms of the principal repayment is important, especially for business plans in their early stages of development when revenues are usually low. These situations are best served if only the interest is paid at first. As revenues gradually increase, it is possible to repay the principal as a lump sum at maturity.

The main advantage of repaying the principal at maturity is that it provides a better match to the standard progression of revenues from business.

People-to-business loan and bank loan

Innovative lending platforms and people-to-business loans with lump sum repayment

What does raising funds on an innovative lending platform mean for the borrower?

The main benefit of innovative lending platforms lies in their speed, coupled with the promotion of the borrower’s business that builds awareness of its presence in the market.

Compared to bank loans that are normally associated with a range of conditions, innovative lending platforms offer greater flexibility and allow the borrower to tweak the terms and conditions (subject to approval by the platform). There is also greater freedom in the allocation of the funds raised.

Advantages and disadvantages of innovative lending platforms

- Feedback on the attractiveness of the project to be funded, raising awareness of your business

- Flexibility, speed, reduced bureaucracy

- Advantages of securing a non-traditional form of funding, communication with investors

- Costs of campaign preparation, costs of promotion, higher transaction costs

- Risk of failure to attract lenders, risk of raising less than expected

- Maximum amount to be raised capped at EUR 1m

Debt or share in ownership?

While taking on a debt requires the borrower to pay fixed interest regardless of profits or the existing situation in the market, the sale of a share in ownership (typically as shares of stock) via an innovative platform brings in new investors and funding (capital) that need not be repaid. However, with the sale of a shareholding, the company management also takes on responsibility for the new, usually anonymous, shareholders who are entitled to their share of equity and profits.

The main characteristic of the sale of a shareholding in return for new equity is the higher degree of risk for the investors, as opposed to simple debt, since in the event of the business getting into difficulties, the investors’ shareholdings are the last to be settled. This is why investors generally demand higher compensation in the form of growth in the value of their shareholdings. This makes equity (funds from the sale of a shareholding) more expensive for the business.

Combining the more expensive sale of a shareholding with less costly debt financing is therefore recommended. Lenders are also usually averse to taking on all the risk and require some involvement of equity. The situation may be compared to a mortgage that does not cover the full cost of the home, with the mortgage holder required to provide 10% to 20% of the price from their savings or other sources.

Types of innovative financing platforms

Basic classification of innovative platforms

People-to-business loans

Bond trading portals

Reward-based crowdfunding

People-to-business loans

People loan their money to a business on the condition that it will be repaid with interest. People-to-business loans are similar to traditional bank loans, but they are different in that the loan comes from a pool of non-professional lenders, be they legal entities or natural persons, who are attracted to a business plan or story published on an online platform.

- Using a people-to-business platform, a company can borrow directly from ordinary people without the need to issue a security (e.g., a bond). The amounts borrowed range from hundreds of thousands to millions of koruna, while the campaign to raise the money may last up to 60 days.

- Repayments are similar to those applicable to a bank loan, with the debtor repaying in instalments covering both the borrowed amount (the principal) and interest. There may also be an option to repay the principal in a lump sum upon maturity.

Bond trading portals

On such a platform, the public can buy bonds issued by businesses with the expectation that they will be repaid with interest.

- The preparatory stage and the selling stage take between one and three months in total, including an online promotional campaign lasting up to 60 days.

- If successful, a business can raise millions of koruna (usually between CZK 5m and CZK 10m).

- Compared to an ordinary loan, the bond issuer only pays the interest, while the borrowed amount (the nominal value) is repaid upon the bond’s maturity.

Platforms that are also authorised securities brokers, act as agents in the issuing and placement of bonds, leveraging their issuing and investing knowledge and experience. Platforms lacking such authorisation only act as marketing mediators, while the contract governing the issued bonds is concluded directly between the issuer and the investor. The platform may offer a template for the necessary documentation.

Reward-based crowdfunding

Reward-based crowdfunding is most commonly used to raise finance for creative and innovative products or services and investors are usually potential customers. The principle of operation is most often based on the time difference between the provision of the funding and the delivery of the product or service. Financial resources raised in this manner can help the receiver of the funds to develop a new product or even to start their business. Where financial resources are used to boost business development, the product or service may be delivered soon after.

Practical example

Historical game was funded by fans on Kickstarter

Warhorse Studio released the successful game Kingdom Come: Deliverance in 2018, which has sold 3 million copies so far. However, at first the company failed to get a publisher, so they requested the support of their fans through the Kickstarter platform. The video describes how the application for funding proceeded, what attractive rewards the developers announced and how they prepared their presentation for Kickstarter.

NAFIGATE Corporation a.s.

What next, where to turn?

Before embarking on the journey, it is advisable to become acquainted with the services and platforms available. It is also wise to contact several such lending platforms and compare their services and costs. It is of course possible to ask the platforms directly at about their manner of operation or to request advice.

- The prospective borrower then begins discussing the admission of their project to the chosen platform and prepares the necessary documentation. This includes financial statements, a proposed repayment schedule and a marketing brief promoting the company and/or project.

- Once the chosen platform has been contacted, its representatives guide the prospective borrower through the whole process from the preparation of the necessary documentation and the promotional campaign to the publishing of the project online and securing of the funding.

Tips and contacts

How to use the website to obtain financingLegal advisersFinancial advisersLegislation and regulations relevant to innovative lending platforms platforms

- One of the fundamental legal regulations governing innovative lending platforms is Regulation (EU) 2020/1503 of the European Parliament and Council of 7 October 2020 on European crowdfunding service providers for business and amending Regulation (EU) 2017/1129 and Directive (EU) 2019/1937 (crowdfunding regulation), effective from 10 November 2021.

- Bond trading platforms must also comply with the provisions of legislation pertaining to bonds, i.e., Act No. 190/2004 of the Czech Legislative Code, on bonds, as amended.

- The core legislation governing commercial companies and cooperatives is Act No. 90/2012 of the Czech Legislative Code, on commercial companies and cooperatives, as amended.

- The core legislation governing the conduct of business on capital markets is Act No. 256/2004 of the Czech Legislative Code, on the conduct of business on capital markets, as amended.