Direct entry of investor

Page views: -

What does “direct entry of an investor” mean?

The term “direct entry of an investor” can describe any situation in which a company obtains funding other than a bank loan or capital raised on financial markets. Instead, private capital derives from investment funds or individual investors.

As it is usually associated with the transfer of a larger shareholding, the entry of an investor usually results in the investor gaining the ability to participate directly in the company’s strategic management and financial decision-making. With such an investor, the company, in turn, obtains support and experience in dealing with strategic issues. However, it is common practice that regardless of the actual size of the shareholding transferred in such a way, the day-to-day management of the company remains in the hands of the original owners.

When is a good time to aim for direct investor entry?

- For new projects or those with an increased level of risk which simultaneously carry significant potential for future value creation

- For projects that take time to start generating revenue; the entry of an investor eliminates the need to repay external funding before revenue is generated

- For small or medium-sized enterprises aiming to increase available working capital or funding for existing or planned projects while facing limited internal resources or difficulties in accessing debt financing

What does direct investor entry mean for the company?

A direct investor becomes involved in the company through their significant shareholding. As such, the investor has a direct interest in seeing the company prosper and develop. The investor may therefore:

- Become directly involved in assisting the company by sharing managerial skills, contacts and knowledge of the financial world

- Act, for example, as a financial adviser, or assist in making strategic decisions or in recruiting key personnel

- Help improve organisational structure, internal processes and/or reporting

- The investor assists the company in good times and bad. Being flexible and experienced, the investor will know that achieving the desired result may take time and that even good enterprises may experience bad spells.

How much does it cost to raise capital from an investor?

The allocation of the costs of securing an investor and of the transaction itself is agreed between the company and the investor, including the possibility of the investor bearing the costs in full. It is therefore impossible to provide any specific figures.

In return for their financial resources, the investor obtains a shareholding in the company and a share of its profits. Investors usually aim to grow the value of the company with a view to selling it in the medium or long term at a profit (such investments are usually held for three to seven years). Another option is to keep the shareholding as a long-term source of a share in profits (such as family office / long-term investment funds).

Advantages and disadvantages of direct investor entry

The costs associated with the transaction itself and securing the investment will be shared between you and the private investor, or the investor will pay them. These cannot be unambiguously quantified.

- In most cases, this manner of raising capital does not burden the company with the need to repay a debt principal and interest.

- It may improve the company’s standing and its chances of securing a bank loan.

- Responsibility in the case of a project failing or the enterprise folding is shared.

- Funds can be raised even by businesses in the very early stages of development, businesses not yet turning a profit or even enterprises in the idea or concept stage.

- The process of raising funds is relatively rapid.

- The investor becomes a co-owner with an entitlement to participate in strategic decision-making.

- The investor is likely to push for increased performance and company growth.

- The investor will demand transparency and reporting.

- The investor is entitled to a dividend, with the resulting reduction in retained profit and funds available to the company.

Raising funds from a direct investor

Direct investors usually look for companies with the potential to create value that stand out in some way among their competitors and hold a promise of success on the market. Investors also appreciate experienced management that can demonstrate skill, commitment and experience in selling the company’s product or service on the market.

In deciding whether to enter the company, investors usually rely on answers to the following questions:

- Does the company offer a competitive product or service?

- Is there a good chance of the company growing significantly in value in the future?

- Does the company’s management team have the necessary experience in the given sphere of business?

- Is the company’s management team capable of and willing to implement a business plan?

- Is there enough potential in the company’s industry / sphere of business?

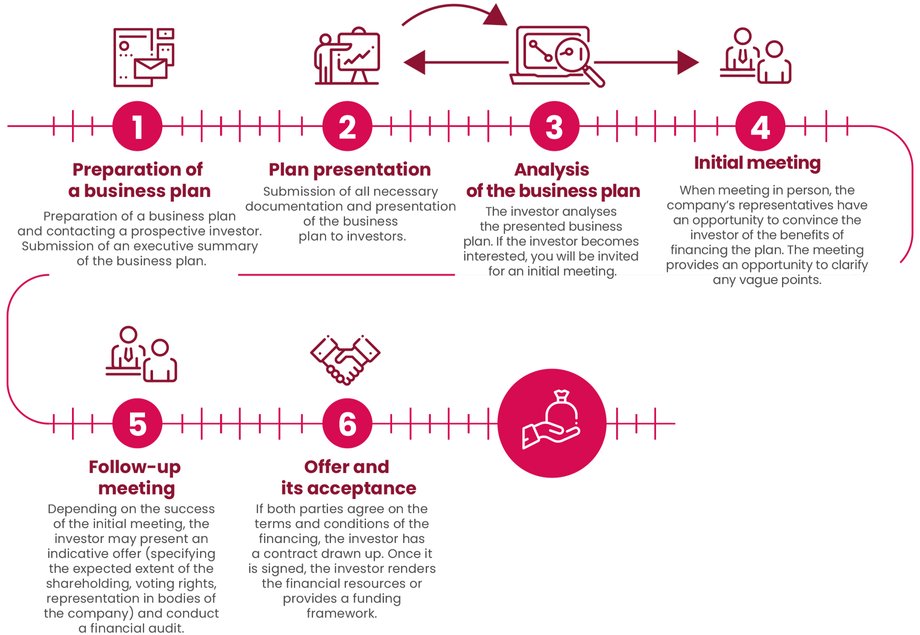

In order to acquire funding for a private investor, it is above all necessary to identify the right type of investor, present a viable business plan and convince the prospective investor of the commercial potential of the company.

Types of investor direct entry

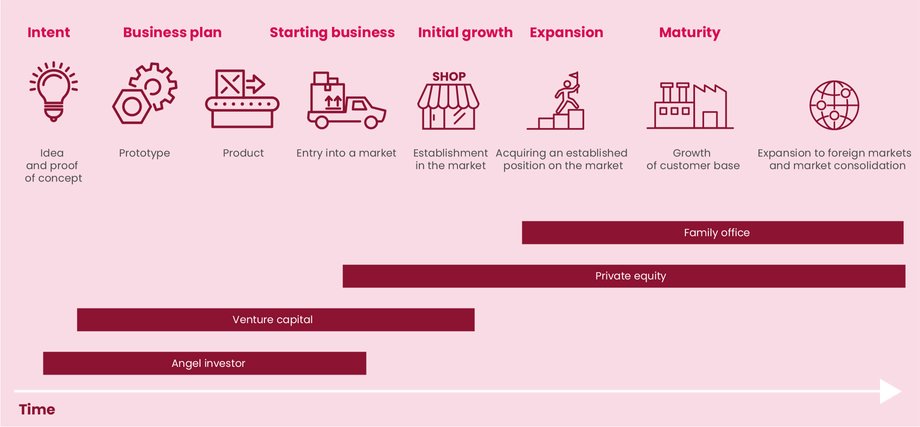

Direct entries by investors into companies differ according to the developmental stage of the given company, the industry in which the company undertakes its business, the amount invested, or geography. A company knows its industry, its geographical market and the investment required.

Basic types of direct investments classified by company developmental stage

Angel investor

Venture capital

Private equity funds

Family office

Angel Investor

Angel investor is a term for someone who invests capital in companies or projects with considerable growth potential. These investments usually support the establishment, initial stages (start-up) and early development of a company, based on a quality business plan that is viable. Angel investors may also invest in a business plan (idea) alone and support the creation of a company to carry it out.

In return for the capital invested, the angel investor obtains a shareholding in the company. The investor also often provides expertise to the early-stage company or even joins the management.

The investment horizon ranges from one to three years. The investor will push for the company to achieve significant increases in its value, revenues and profit during this time. The investor may also influence the company’s management with a view to driving its growth. Given the considerable risk associated with the investment, the investor will expect an adequate performance from the company.

Angel investors typically focus on:

- Seed capital – i.e., financing the development of a product or service before a formal marketing business entity is established. Such an investor may, for example, provide financial resources to an entrepreneur developing a product prototype.

- Start-up capital – at this stage there is already a product/service and a business plan that an entity intends to execute in order to establish itself in the market.

- Early-stage expansion capital – here, a company is already established in the market. It is generating revenues from sales of its products or services but is yet to turn a profit. The company’s losses may be temporarily covered by an investment if there is a sufficiently positive outlook.

What will convince an angel investor of the merits of investing in an idea/company?

- An innovative idea with a solid promise of growth and geographic expansion

- Capable team

- High-quality business plan

- Improving results of the company (if already in existence)

Venture capital funds

Similar to investments made by angel investors, venture capital targets medium to long-term investments in early stages of development. Venture capital funds tend to mitigate the level of risk involved by focusing on sectors with considerable growth potential in order to achieve required returns for the risks undertaken.

Compared to angel investors, venture capital funds generally invest greater volumes of financial resources, collected from a wider pool of investors. Venture capital funds also usually do not invest in business plans (ideas) but seek existing young companies. Exceptional ideas with the potential for considerable future returns may attract investment in the associated business plans from what is known as proof of concept funds. Typically, these examples involve outcomes of research and developmental activities.

Venture capital funds typically focus on:

- Start-up capital – at this stage there is already a product/service and a business plan that an entity intends to execute in order to establish itself in the market.

- Early-stage expansion capital – here, a company is already established in the market. It is generating revenues from sales of its products or services but is yet to turn a profit. The company’s losses may be temporarily covered by an investment if there is a sufficiently positive outlook.

- Second stage funding – in its second stage of development, a company aims to establish itself firmly in the market, possibly introduce another product or service or enter new markets. Additional funding is sought mainly to develop new products, increase working capital or launch a new product.

What will convince investors of the merits of investing their venture capital?

- An innovative idea with a solid promise of growth

- Capable team

- High-quality business plan (supported by detailed financial model based on real data)

- Improving financial results

Private equity funds

Private equity funds generally invest in companies with a proven track record that are firmly established in the market. Funding for further growth/development is often supplemented by debt financing. In return for their financial resources, the investor obtains a minority or majority shareholding, depending on the type of private equity fund and the particulars of the agreement between the two parties.

A private investor usually enters a company by investing their own financial resources, made available to the company through a combination of an increase in the company’s equity and a loan. The investment horizon for the private investor is usually between three and seven years, after which the investor exits either by selling their shareholding to another investor or by floating the company on the stock market (IPO). Private equity funds aim to ensure that the company increases its value, revenues and profit. They therefore tend to influence company management accordingly to secure profit once they are on board.

Private equity funds typically focus on:

- Expansion capital – in its expansion stage, a company aims to establish itself firmly in the market, possibly introduce another product or service or enter new markets. Additional funding is sought mainly to develop new products, increase working capital or launch a new product.

- Mature age funding – here, the company is already established in the market and generates good profits. However, even established, mature-stage companies need equity financing to fund further development. Such financing may be used, for example, for acquisitions or establishing a subsidiary.

What will convince a private equity fund of the merits of investing in a company?

- High-quality project demonstrating potential for further growth

- Solid financial results

- Ability to create/maintain a competitive advantage

- Strong core management team

- Clearly defined potential route to liquidity through the sale of a shareholding (exit)

Family office

Family office is a type of investment company that maintains the assets of a wealthy family, usually in the billions of Czech koruna. The purpose of a family office is to ensure the stable growth of the assets’ value and the distribution of profits to members.

As an asset management entity, a family office invests in companies with proven track records and well-established positions in the market that can reliably generate returns on investment.

Family offices are generally established for an indefinite time and as such they focus on long-term investments. A company that performs well may remain in a family office portfolio for any length of time.

Family offices focus on:

- Mature age funding – here, the company is already established in its markets and generates good profits. However, even established, mature-stage companies need equity financing to fund further development. Such financing may be used, for example, for acquisitions or establishing a subsidiary.

- Expansion to neighbouring foreign markets / market consolidation – companies need equity financing to fund their development at every stage of their life cycle. In the latter stages, this may typically involve an expansion into foreign markets or consolidation of a company’s position in its domestic market.

What will convince a family office of the merits of investing in a company?

- High-quality project demonstrating potential to sustain profit

- Long-term solid financial results

- Complete, highly skilled management team and an organisational structure fit for purpose

Practical example

The investor helped with foreign expansion

Fruitisimo is a brand of fresh bar outlets, situated in shopping malls, which make fruit and vegetable drinks right in front of customers. The company expanded rapidly, and to grow abroad, began to consider the entry of an investor. The company hired a professional advisor who guided the owners through selection and the entire entry process.

What next, where to turn?

When looking for the right investor, it is essential to match their area of focus to the company’s needs.

Different investors seek targets for their investments according to the:

- Current stage of development of the considered company

- Industry in which the company is involved

- Geographical market

- Size of investment sought to execute the intended business plan

A direct investor entry constitutes a major strategic decision. It involves a once-in-a-lifetime process for the company. It is therefore essential that it is executed without a hitch at the first attempt. For most companies it would be uneconomical to employ experts specialising in capital markets, responsible in the company solely for this area. It therefore makes sense to hire outside advisers for the task.

An adviser relies on extensive prior experience in the area of securing financing from investors. An adviser can take charge of the complete process of acquiring an investor. Advisers are rewarded for the success of the process and can also negotiate favourable conditions for the transaction concerned.

Tips and contacts

How to use the website to obtain financingLegal advisersFinancial advisersLegislation and regulations relevant to direct investor entry

- Private capital is regulated primarily by the EU’s Alternative Investment Fund Managers Directive (AIFMD) transposed into the Czech legal system by Act No. 240/2013 of the Czech Legislative Code, on investment companies and investment funds.

- Act No. 15/1998 of the Czech Legislative Code, on capital market supervision.

- Regulation (EU) No 345/2013 of the European Parliament and of the Council of 17 April 2013 on European venture capital funds.

- Regulation (EU) 2015/760 of the European Parliament and of the Council of 29 April 2015 on European long-term investment funds.