Stock markets

Page views: -

What is a stock market?

A stock market is part of the capital market where (publicly tradable) shares of stock are bought and sold. Also called a stock exchange, a stock market is where companies can raise capital by selling shares, which can subsequently be traded on the market (exchange).

By issuing and selling shares, a company can raise financial resources to accelerate its growth and development while simultaneously acquiring new shareholders/owners.

Stock markets in the Czech Republic

Stock markets in various countries are configured differently. This also applies to the optimum parameters for entry into a stock market. The primary market of the Prague Stock Exchange (PSE) is configured primarily for trading the shares of medium-sized and large companies. PSE thus provides a setting for the efficient offering of shares worth CZK 500m and above of businesses with a market capitalisation of CZK 2bn or more. (For more details see Types of stock market in the Czech Republic below.)

As these parameters are set too high for many companies, in 2018 PSE launched its START market for small and medium-sized enterprises (SMEs) seeking to raise capital of tens of million Czech koruna.

PSE thus currently operates three markets in which companies’ shares of stock are offered and traded. These are primarily the STANDARD and PRIME markets, while there is also the smaller START market intended for SMEs.

START Market

START is a market for smaller, innovative companies with a capitalisation of CZK 25m or more looking to raise new capital. It is also suitable for business owners looking to capitalise their shareholdings and make a full or partial exit from their enterprise. An advantage of START, compared to similar markets in other European countries, lies in its reduced costs for the issuer. As a result, the cost of the capital raised on the market is on a par with any other form of funding or exit.

- CZK 25m ≤ market capitalisation ≤ CZK 2bn

- Simplified prospectus, Czech accounting standards, independent research analysis

- Flexible options for raising capital in further rounds

STANDARD and PRIME markets

The STANDARD Market is intended for the trading of shares in large and prestigious Czech and foreign companies. The STANDARD market admits stock issues that meet either the more stringent conditions of the official securities market or the statutory requirements governing the regulated market. PSE also permits the listing of shares without the consent of the issuer, if they are already traded on another regulated market within the EU.

The PRIME Market is intended for the trading of shares in the largest and most prestigious Czech and foreign corporations. The PRIME market admits share issues meeting either the more stringent conditions of the official securities market or the statutory requirements governing the regulated market.

To trade on either of the markets, issuers must meet the prescribed criteria, including:

- Market capitalisation of issue no less than EUR 1m.

- Free float (portion of issue in the hands of public investors) of at least 25%.

- Issuer’s existence of at least three years.

When to enter the stock market in the Czech Republic

In comparison to the situation with a bank loan, the issuing company is not obliged to repay the financial resources raised through the sale of its shares. That makes a sale of shares a good option for raising capital at every stage of a company’s life cycle, including the initial stage when the company is yet to generate sufficient profit from which to repay debt financing.

The main characteristic of underwriting shares is the higher risk posed to investors in contrast to debt instruments. In return for taking on this extra risk, investors require a higher reward. That raises the cost of equity (financial resources) to the issuer.

The optimum solution is therefore to combine equity and debt. Lenders are also usually unwilling to accept all the risk and often require that creditors’ own resources and assets are involved. The situation is like a housing mortgage that does not cover the full price of the property and requires the mortgage holder to pay 10% to 20% of the price.

Companies increase equity by selling (offering) shares of stock:

- To acquire funds for further growth and development (certain growth activities cannot be financed by debt, only by equity)

- To acquire a competitor or incorporate other businesses within an industry

- To increase credit limits or reduce debt

What do investors expect?

- A share in the profits of the issuing company distributed as a dividend

- Growth in the share price value (reflected in the value of the investor’s shareholding)

To enter the START market, companies must meet the following conditions:

- Registered as a joint-stock company (a. s.) or as a European company (SE)

- Registered seat in the Czech Republic

- Audit covering most recent two or three years, or the entirety of the company’s existence

- Czech accounting standards

- Offer a large enough shareholding to create sufficient liquidity (ideally between CZK 25m and 50m)

The benefits of entering the stock market

- By selling shares, the issuing company reduces the shareholding of its existing owners but increases the company’s market valuation.

- Increased equity, reduced debt.

- Increased prestige and transparency for business partners.

- Exposure due to promotion of the initial public offering (IPO).

- Improved access to other methods and sources of financing thanks to an increase in equity (a combination of debt and new equity is the most efficient approach).

Cost of entering Prague Stock Exchange

An estimate for a model case of a company aiming to sell shares.

| Value of stock sold | CZK 50m | CZK 100m | CZK 200m | |

|---|---|---|---|---|

| Lead manager | Consulting related to the offering | CZK 300,000 | CZK 300,000 | CZK 300,000 |

| Commission for successful placement (2%) | CZK 1m | CZK 2m | CZK 4m | |

| Legal counsel | Creation of statutory due diligence report (by a PSE-authorised counsel) | CZK 200,000 | CZK 200,000 | CZK 200,000 |

| Commission for the creation of a prospectus and application for its approval by the Czech National Bank | CZK 400,000 | CZK 400,000 | CZK 400,000 | |

| Analyst | Commission for the creation of an analytical report | CZK 150,000 | CZK 150,000 | CZK 150,000 |

| Total one-off costs | CZK 2.05m | CZK 3.05m | CZK 5.05m | |

| One-off costs as percentage | 4,10% | 3,05% | 2,53% | |

| Yearly administration costs | CZK 150,000 | CZK 150,000 | CZK 600,000 | |

Advantages and disadvantages

- Access to capital with no interest or repayment schedule attached (distribution of profit depends on business success).

- Relative freedom in allocation of the capital raised.

- Flexibility (decisions on dividend made by the company).

- Minority shareholders cannot control strategic management.

- Increased credibility and exposure.

- Possible pressure from investors seeking to collect dividend.

- Stock value influenced by factors beyond issuer’s immediate control (the value is not only affected by the success of the issuer’s business, but also by market sentiment, developments in the issuer’s industry, the overall macroeconomic situation and other factors).

- Majority shareholder or a group of shareholders can acquire control over the company.

- Information and reporting duties towards shareholders.

- Increased corporate governance demands.

Entering a stock market

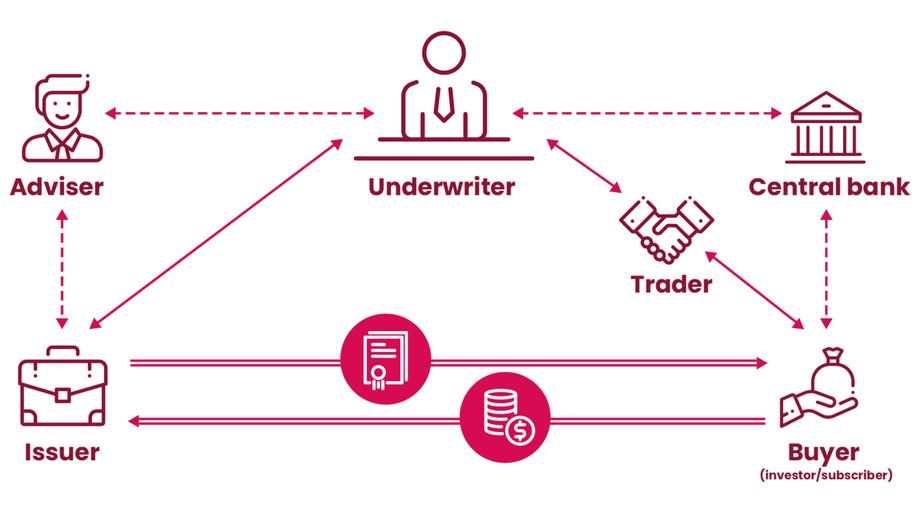

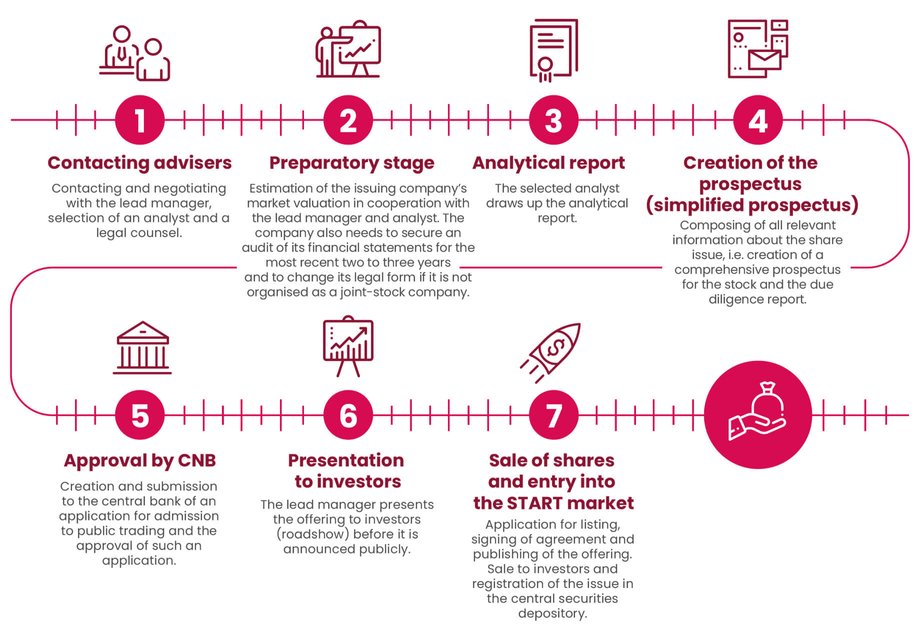

The process of issuing shares is rather demanding. The recommended path therefore involves taking advantage of the services of experienced advisers. The first step is to select an underwriter / lead manager to act as the issuer’s main partner for the IPO. The lead manager accompanies the issuer throughout the process, overseeing all steps that need to be taken. In cooperation with a team of lawyers and analysts, the lead manager also helps with the preparation of the prospectus (information document).

The prospectus contains the information required for investors to make an informed assessment of the securities being offered, the associated rights and the issuer’s assets and liabilities, as well as their financial standing, profit and loss and business outlook.

Key requirements of a successful IPO

- Clearly defined business strategy

- Attractive corporate story with potential to capture investors’ imagination

- Experienced management

- Transparent corporate structure

- Good timing of the IPO

- Readiness to share selected internal information

Entering the START market

Entry to the START market can be achieved considerably more rapidly than entering PSE’s main markets, STANDARD and PRIME. However, the actual length of the process will still depend on the degree of readiness of the issuing company.

It is of course possible to raise capital through the stock exchange more than once. Subsequent rounds of raising capital generally require less effort and time thanks to the experience gained with the IPO. The documentation created for the initial offering can be reused to a greater or lesser extent in the subsequent rounds.

You can read about success stories of entering the START market on the BCCP website. https://www.pxstart.cz/pribehy-firem/

The coordination of the whole transaction comes under the remit of the lead manager who assists the issuer throughout the process. The lead manager, working closely with the legal counsel and analyst, also provides assistance with the preparation of all the necessary documentation required to enter the START market.

The issuer, lead manager, analyst and legal counsel cooperate in the creation of the following documents required for START market entry:

- Memorandum – cooperation agreement

- Application for admission

- Proof of ISIN assignment (registration of stock in the Central Securities Depository Prague (CSD Prague))

- Prospectus for stock approved by the Czech National Bank (CNB)

- Statutory due diligence report

- Analytical report

- The issuer’s Articles of Association.

The process of entering the START market comprises the following main steps:

To enter the START market usually takes between 6 and 12 months, depending on the initial readiness of the issuer. Once listed on the market, the shares can be traded on the PSE in daily morning auctions (9am to 12.30pm).

The process does not end after entering the market as the issuer takes on further obligations towards the new shareholders:

- Publication of annual reports and/or financial statements

- Regular publication of analytical reports for each year

- Disclosure of all information that can affect the stock value.

- Presentations of company information at least twice per year

- Mandatory invitations to shareholders to take part in general meetings

Types of shares

Common stock

Regular stock with no special rights attached. Ownership of common stock entitles the shareholder to vote at general meetings (i.e., make decisions about the company) and to receive a dividend (share of profits).

Preferred stock

Ownership of preferred stock entitles the holder to receive a dividend (share of profits) before holders of common stock. Holders of preferred stock also take precedence when recovering investments in the event that the assets of the company are liquidated.

Employee stock

Companies use employee stock as a form of remuneration and as an incentive for employees as ownership entitles holders to a dividend (share of profits). Employee stock is usually subject to curbs on voting rights and sale to persons outside the company.

Practical example

Stock exchange from the perspective of an entrepreneur

Petr Koblic, CEO of the Prague Stock Exchange, revealed what the capital market has to offer small and medium-sized enterprises. The interview clearly explains what a stock exchange is, who can go there for capital and when is the best time to use the stock exchange. You will also learn which sectors are popular now, how much it costs to be quoted on the market and what risks you may encounter.

Karo Leather a.s.

What next, where to turn?

Where to go at the start of the process

The first step is to select and appoint the lead manager who will act as the main partner for the initial public offering (IPO).

The lead manager’s remit:

- To accompany the issuer throughout the process and oversee all necessary steps

- To secure the creation of the prospectus in cooperation with a team of lawyers and analysts

- To assist in the creation of documentation and materials related to the offering

- To assist in presenting the offering to investors during the roadshow.

A team of third-party advisers recruited to assist in entering the stock market proceeds jointly with the lead manager. The team typically consists of:

- Lead manager

- Legal counsel

- Analyst

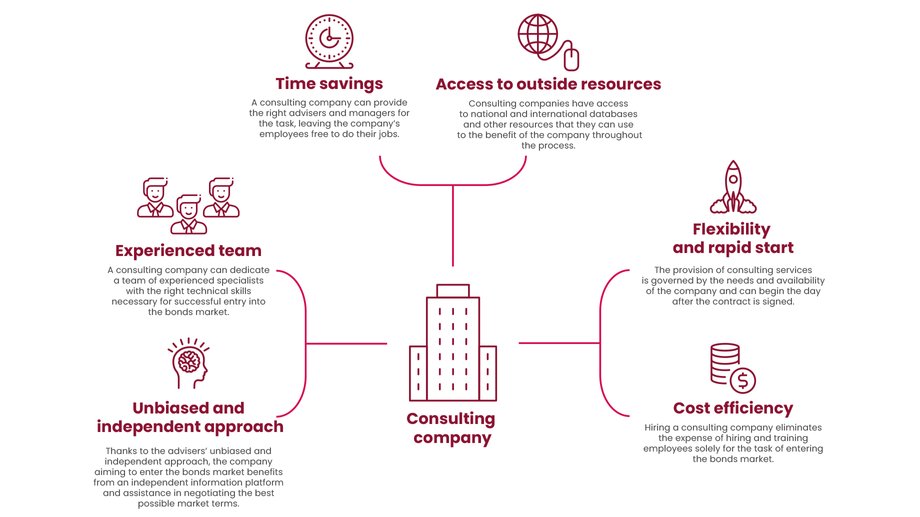

Advantages of retaining a consulting company:

Despite the option of completing the whole process without third-party assistance (consulting company), in reality there are very few companies that have their own capacity for this. The vast majority employ people with stock market experience and it is not financially viable for them to hire additional staff only to manage entry to the stock market. Most companies therefore hire a financial advisor, paid according to their success in dealing with the whole process.

Tips and contacts

How to use the website to obtain financingLegal advisersFinancial advisersLegislation and regulations relevant to the stock market

- The core legislation governing the conditions of issuing shares of stock is Act No. 89/2012 of the Czech Legislative Code, Civil Code, as amended.

- The core legislation governing commercial companies and cooperatives is Act No. 90/2012 of the Czech Legislative Code, on commercial companies and cooperatives, as amended.

- The core legislation governing the conduct of business on capital markets is Act No. 256/2004 of the Czech Legislative Code, conduct of business on capital markets, as amended.

- The core regulation governing the obligations pertaining to a prospectus describing a securities issue is Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus.

- The relevant legislation and regulations are supplemented by rules applied by the PSE (BCPP).