How to make the most of the Capital Guide website?

Page views: -

The website at kapitalovypruvodce.cz provides an overview of the basic types of financing available on the capital market. A business can use this to navigate their way through the world of non-banking financing when extra funds are required for their operations and continued development.

The website aims to provide the basic information necessary for making an informed decision on the suitability, costs and benefits of individual types of business financing. It can serve as a launchpad for entrepreneurs looking to compare the different types of financing available and choose the right adviser/specialist to assist in securing the funding necessary for further business development.

Why cooperate with an adviser/

specialist?

By definition entrepreneurs are people willing to take risks. However, the ability to create a successful business enterprise may sometimes make the entrepreneur feel that they have no need for a specialist adviser.

Entering a non-banking capital market is a fundamentally important strategic move, often undertaken just once during the lifetime of a company. This is why it should be executed correctly at the first attempt. For most businesses, it does not make economic sense to employ in-house capital market specialists, tasked solely with the capital market agenda. On the other hand, advisers specialise in the field and possess extensive, long-term experience in the processes applied to securing funding from the capital market.

It is therefore advisable to consider retaining the assistance of a financial adviser who can take charge of the whole process and is paid to secure a successful outcome. Specialist advisers can also assist in negotiating advantageous conditions for the eventual financing transaction.

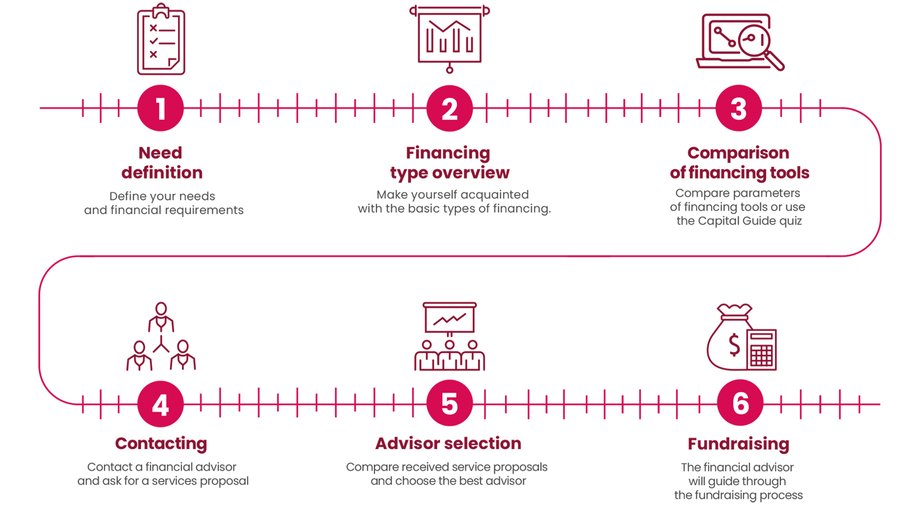

Steps in securing funding

What follows is a brief guide to utilising the kapitalovypruvodce.cz website in acquiring an understanding of the capital market, finding the right experts and securing funding. The simple guide is broken down into six steps.

1. Identifying funding needs

It is best to start by assessing the company’s direction, its planned projects and the associated costs of realising them. This information should then be used to determine the following:

- How much money is needed to finance the project(s) in the pipeline?

- How quickly does the funding need to be secured?

- Are the company owner and the management willing to cooperate with an additional investor?

2. An overview of types of financing available on the capital market

Before seeking and contacting an adviser/specialist, it is advisable to become acquainted with the basic types of financing available, including the characteristics of each, as the choice needs to match the company’s specific needs. The main questions are:

- How much money can the company secure?

- When is a good time to rely on each type of financing?

- What are the potential benefits of specific types of financing?

- What are the costs of the chosen option?

The Capital Guide provides information on the different types of financing available on the capital market, the situations best suited to each type of financing, the costs associated with each type, their main advantages and disadvantages, and brief descriptions of the processes involved in securing them.

Each section also contains a video and an article featuring an entrepreneur who successfully relied on the given type of financing and can therefore share useful information about their experience.

3. Comparing types of financing

Write down key parameters and compare the merits and accessibility of the different types of funding.

Alternatively, you can also use the Capital Guide quiz to whittle down the available options to those most suitable.

4. Contact information for advisers/specialists

Once the most suitable types of financing, matching the company’s needs, have been identified, it is sensible to assess what is expected of the adviser. Based on the outcome, the most suitable adviser should be selected. The Capital Guide offers a list of advisory companies / specialists possessing a wealth of experience in dealing with the individual types of funding.

Try to acquire as much information as possible about each advisory company being considered. Do not hesitate to directly approach the companies for information, without entering into a binding arrangement.

As most businesses do not employ their own experts on funding via the capital market, in most cases it makes sense for them to retain the specialist services of an advisory company.

A business enterprise can, of course, choose to secure the necessary funding without relying on the services of specialist advisers. This approach is suitable, especially in situations when the amount of funding sought is not too large, for fairly standard processes. Innovative lending or a shareholding platform provide good examples. These platforms generally operate along the lines of well-defined processes and they guide businesses seeking external funding all the way through, thus acting to a certain degree in the role of a financial adviser.

5. Selecting an adviser

A company seeking external funding should contact several different advisory companies with requests for information on services available, including references. Any successful advisory company will be able to list several satisfied clients. Endeavour to assemble all the information necessary to make a well-informed decision on which adviser to select.

When contemplating the use of an innovative platform, businesses can contact the platforms’ respective experts.

6. Securing funding

Based on a thorough survey, the company interested in securing external funding selects a financial adviser who then assists the company throughout the process, including setting the transaction’s parameters in accordance with the company’s requirements.

The adviser’s commission should be agreed, based on the success of the operation. That way, the adviser is motivated to secure the best conditions possible on the given subset of the capital market.

When using an innovative platform, the platform’s own experts act as advisers and guide the company through the process.